Jeb Bush has set the presidential race pace with a promise of 4% growth. Other contenders, Democratic and Republic, will make similar promises, or perhaps already have – I've not looked. My intent here is to examine the issue, not the man.

In the medium and long run growth rates are about the supply side. Now in the short run demand factors matter, and since we're still in recovery from our Great Recession, we can hopefully have a few years of above-normal growth. My own estimation, taking into account the retirement of the baby boomers, is that we're about 7 million jobs short of where we need to be. Of course the next Administration won't take office until early 2017, and realistically their policies won't kick in until 2018. We're adding jobs at a 2 million per year pace. So if we keep that up, by then we'll be pretty close to normal. Looking at the supply side is thus sensible.

4.0% growth isn't going to happen

So what are long-term growth prospects? Basic (macro)economics is that over the long haul growth is a weighted average the growth of inputs – here I look at capital and labor – and total factor productivity, the growth of the economy over and above that due to more inputs. Work in this tradition goes back to a 1957 paper by the Nobel laureate Robert Solow; we thus have nearly 60 years of work, and a sense that the approach is pretty robust way to organize our thinking. So what we need to do is gauge the range of these three factors.

Let me begin with labor force growth. My own estimate, based on Census projections of the population by age and the propensity of people of different ages to work, is that by 2018 the underlying trend will be on the order of 0.4%. Now the baby boomers are working longer than their predecessors, so this may prove a tad low, but it is the right order of magnitude. For example, if we look at past employment growth, we see that it has gradually fallen over the past 75 years, averaging over each decade. While the rate as of January 2015 was 2.0%, that reflects the recovery from the deep trough of 2009 and is not sustainable. In fact, the (geometric) average of employment growth since 2000 is 0.5%. So I'll use that as my base case.

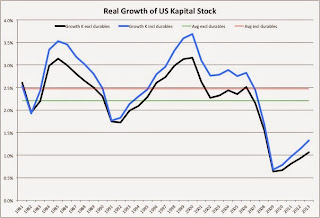

Next is the growth of productive resources, factories and housing and cars and shopping malls. At present investment is far below normal, particularly for structures and residential, and for investment by the government (down in all subcategories, from roads to office equipment). So we could see an uptick. Looking at the pre-Great Recession average, we might see 2.2% growth in business and residential investment, and 2.5% if we add in consumer durables such as automobiles. On the other hand, with population growth down and the average age rising, we may well see all forms of construction remain at lower levels. I'll use the higher numbers here.

Finally, there's productivity. The trend over the past roughly 30 years is 1.1% growth (or more precisely 1983-2011), with a lot of volatility. Will it come in higher? I see no reason to think that will happen. Yes, we are seeing lots of innovation. No, it is not boosting growth. Biotechnology has been advancing for 10,000 years, since the early domestication of wheat, sheep and cattle. To pick one modern crop, selective breeding at the International Rice Research Institute in Los Baños, Philippines led to high-yielding varieties in the 1960s. Modern genetic engineering is a continuation of this trend, and the productivity gains from the standpoint of the overall economy of future innovation will be modest. Likewise adding to longevity will do little in the short run to boost output, as reversing the trend toward retirement will require decades. IT is leading to an array of gadgets, but "robots" have been central to our factories for the past 2 decades, and while my first computer could not always keep up with my typing speed, in my own work I've seen diminished returns to improvements in hardware, software and improved data resources. As emphasized by Robert Gordon, there are many reasons to think that productivity gains will not pick up. Even if they do, that's also a long-run process, as workplaces gradually reorganize to incorporate new tools. In sum, we won't see a surge during 2018-2021; a 1.0% rate is all we'll get.

...and there's not much a future president can do about it

Let's put it together: 1.0% productivity, 0.5% employment growth, 2.5% capital growth. Discount the latter (as per economic theory) for diminishing returns (which matches their share in output) by (respectively) 0.6 and 0.4. That gives us 1.0 + 0.3 + 1.0 or 2.3% growth.

Guess what? Growth of 2.3% happens to be what we've averaged since the 2009 trough of our Great Recession. It's also consistent with interest rates, as the gap in yields between 3- and 5-year bonds implies 1-year interest rates of 2.2% in 2019 and 2.6% in 2021. (Look for a pending post.)

So 4.0% growth isn't going to happen, and there's not much a future president can do about it.

No comments:

Post a Comment