Mike Smitka

Prof Emeritus of Economics

Automotive News PACE Awards Judge

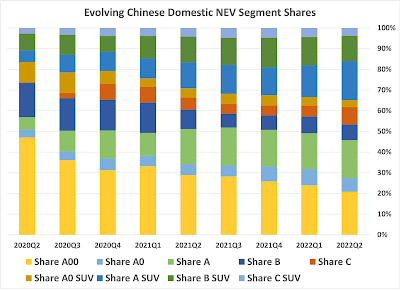

I've been tracking Chinese sales data for a couple years, and pulled together thoughts in a brief article, China NEV Segment Analysis, on the finance website Seeking Alpha. The midsized segments, both sedans and SUVs, are stagnant. That's where Tesla's Model 3 and Model Y compete. In contrast, the compact "A" segments are expanding. Players there include one one startup, XPeng, but has BYD, VW and Geely as major players. To my surprise, I also find SOEs with decent shares, particularly GAC's Aion [GAC is owned by the Guangzhou Municipal government]. Most of the SOEs have lived quite well off of profits earned by their joint venture partners, such as Toyota and Honda for GAC. Are these proper commercial ventures, drawing upon the experience of SOEs in designing vehicles and running factories? Historically the SOEs were poor at design and at marketing. Some of that is the home boy effect – you won't find many Aion vehicles on the streets of Shanghai or Beijing. I don't know the produzct, I'm not a "car guy," so maybe these are real ventures properly run with earning money as a goal. But they could also be the result of party hacks pushing management to follow the EV trend, using their joint venture profits to make up for a lack of business acumen (and a very crowded market).

I also argue that the car market faces many headwinds. China has worked through the demographic dividend generated by falling birth rates, but now the working age population is shrinking, and probably the overall population as well. It's easy among the monthly NEV sales hype to overlook that the overall Chinese car market peaked in 2017. Then there's the end of the real estate bubble, evidenced by the failure of Evergrande, and the prospect of continuing lockdowns, an ironic side effect of China's initial success in using a combination of testing, contact tracing and quarantines to suppress the pandemic. There's no concrete left to pour after the huge infrastructure expansion that kept China from suffering the worst effects of the US real estate meltdown. That ammo has been depleted, and while Beijing talks about boosting car sales to offset the slowdown, consumers can't sell the condo that represents the biggest part of their life savings, and on top of that are worried that their bank may be the next one to shut its doors.

In any case, it will be interesting to see who does well in the NEV market, which just (barely) set a new sales record in July of 560,000 units. I think it's the bigger players who will fare well. VW's R&D spend is $3.6 billion a quarter; that's more than the combined revenue of XPeng and Nio, two of the current "pure play" EV favorites. Cars are in the end a consumer product, and having a broad, regularly refreshed portfolio of models on offer is of the essence. So my belief is that in the end the global OEMs will do well, and one or more of the private Chinese car companies: BYD, Geely and Great Wall. BYD is already in 6 of the 9 segments I tracked, as is Geely. VW, despite its late start, is already in 7. They cover most of the bases already. In contrast, Tesla can't seem to get new product out the door, and is stuck with but two models, and those in the stagnant mid-sized segment. They aren't heading towards failure, but they do risk being left in the dust as an also-ran.

No comments:

Post a Comment